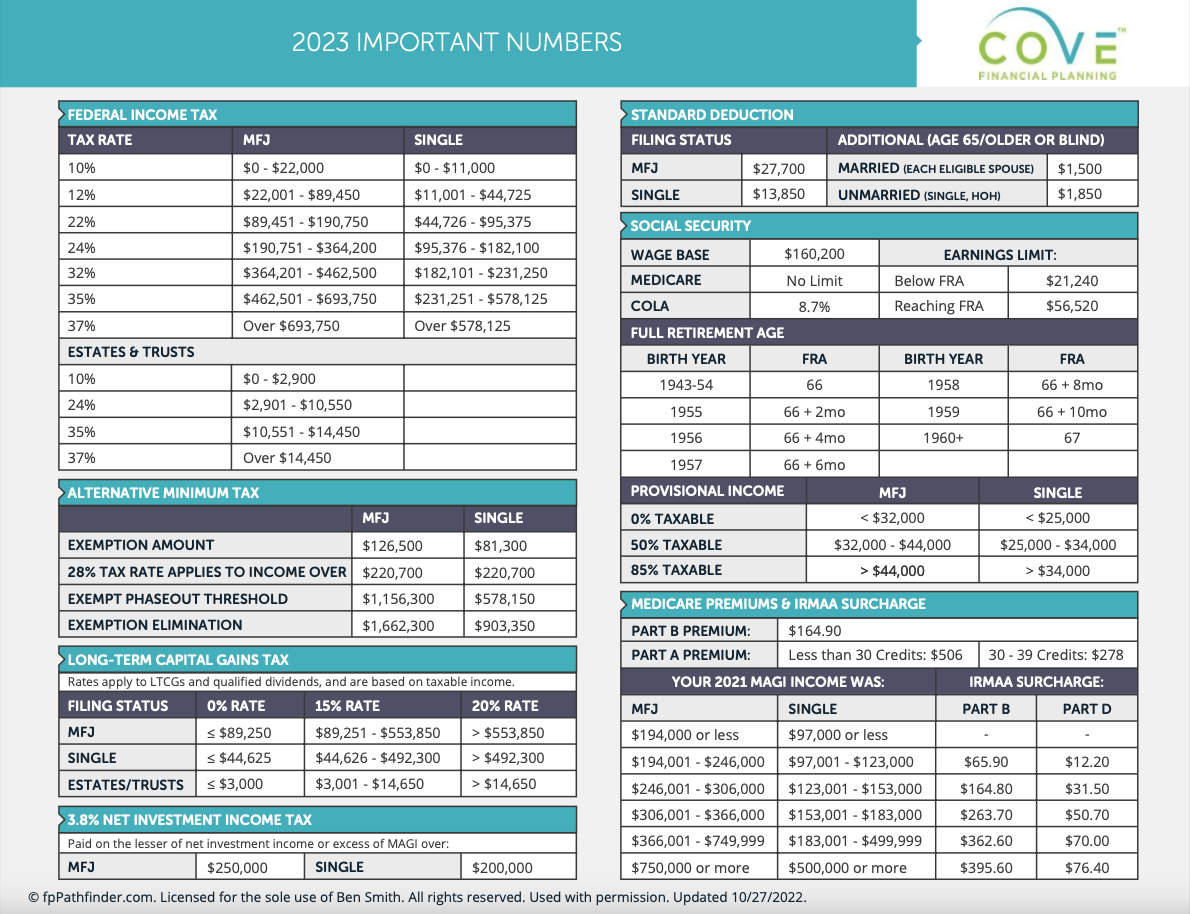

2023 Important Tax Numbers

Tax brackets and maximum contribution limits to certain accounts changed for 2023 which could impact your financial plan and tax situation.

A few notable highlights include:

401(k) contribution limits increased:

$22,500 personal contribution limit (up from $20,500 in 2022)

$7,500 catch-up contribution limit for people age 50 and older (up from $6,500 in 2022)

Traditional and Roth IRA contribution limits increased:

$6,500 contribution limit (up from $6,000 in 2022)

$1,000 catch-up contribution limit for people age 50 and older (no change from 2022)

Health Savings Account (HSA) contribution limits increased:

$3,850 individual contribution limit (up from $3,650 in 2022)

$7,750 family contribution limit (up from $7,300 in 2022)

Standard deduction increased:

$27,700 for married filing jointly (up from $25,900 in 2022)

$13,850 for single filers (up from $12,950 in 2022)

Gift tax annual exclusion increased:

$17,000 per person (up from $15,000 in 2022)

Federal income tax brackets shifted

Required Minimum Distribution (RMD) uniform lifetime table adjusted

Do you have questions about how these tax numbers impact your financial plan? Reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Minneapolis, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.