2025 Important Tax Numbers

Happy New Year! I hope you enjoyed the holidays and New-Year celebrations.

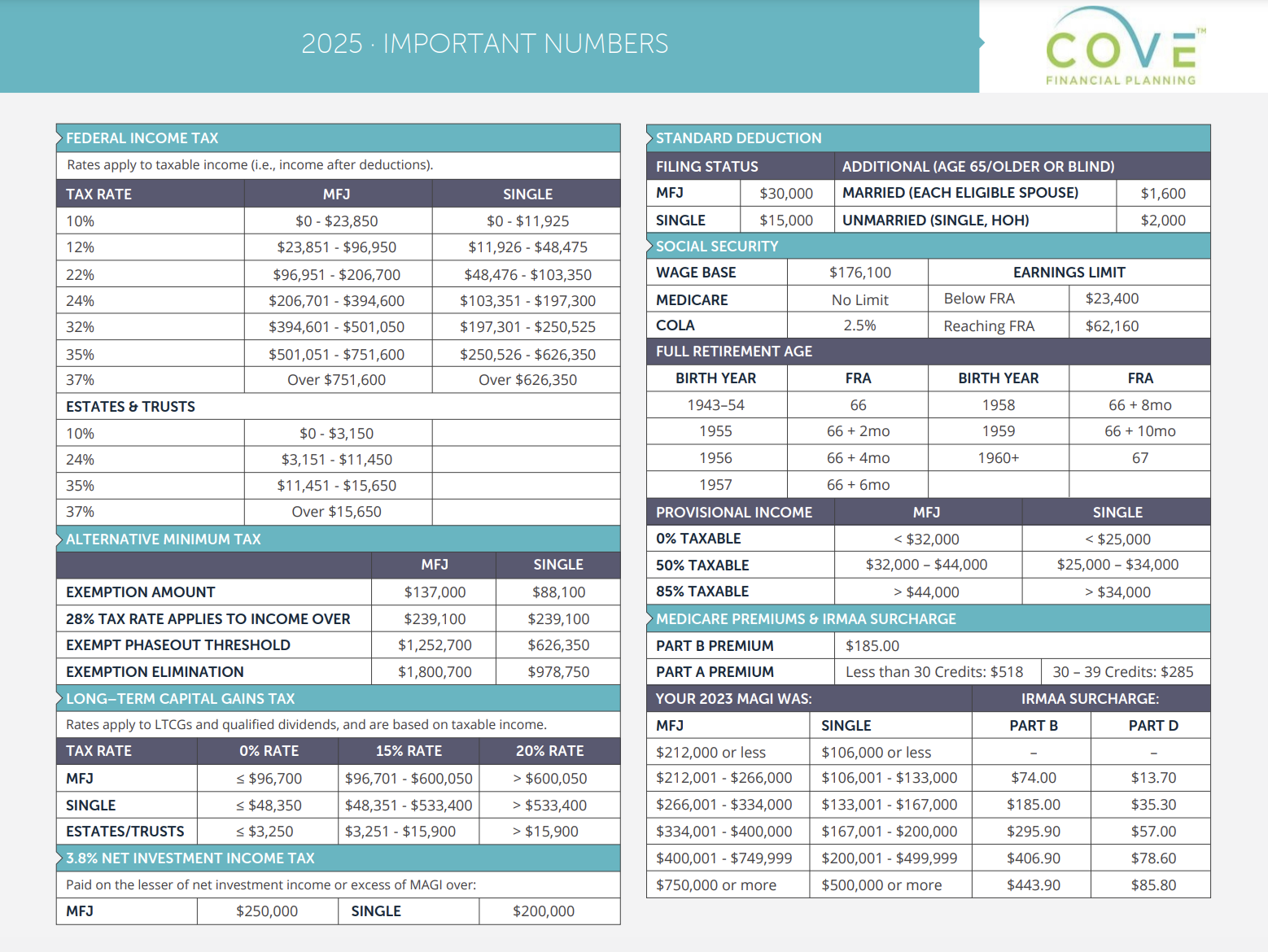

With the start of the new year, I am writing to provide an update on tax- and retirement-related changes in 2025.

Specifically, tax brackets and retirement-plan contribution limits to certain accounts changed for 2025 which could impact your financial plan and tax situation.

A few notable highlights include:

401(k) and 403(b) contribution limits increased:

$23,500 personal contribution (up from $23,000 in 2024)

$7,500 age 50+ catch-up contribution remains the same

NEW: $11,250 age 60-63 “super” catch-up contribution

$3,000 additional 403(b) catch-up contribution after 15+ years of service

Health Savings Account (HSA) contribution limits increased:

$4,300 individual contribution (up from $4,150 in 2024)

$8,550 family contribution (up from $8,300 in 2024)

$1,000 age 55+ catch-up contribution remains the same

Traditional and Roth IRA contribution limits remain the same:

$7,000 base contribution

$1,000 age 50+ catch-up contribution

Roth IRA income phaseout increased:

$150,000 - $165,000 for single filers

$236,000 - $246,000 for joint filers

Standard deduction increased:

$30,000 married filing jointly (up from $29,200 in 2024)

$15,000 single filers (up from $14,600 in 2024)

Gift tax annual exclusion increased:

$19,000 per person (up from $18,000 in 2024)

Federal income tax brackets shifted higher

Capital-gains tax income brackets shifted higher

Required Minimum Distribution (RMD) uniform lifetime table adjusted

Do you have questions about how these tax numbers compare to 2024 and impact your financial plan? Reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Wayzata, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.