3 Tips for Riding Out the Ups and Downs

Have you seen all the red in the news lately? I’m hoping you’re heeding my advice and not looking too closely at daily stock-market performance, as it won’t play a meaningful role in your long-term financial plan.

That said, the market has certainly been volatile so far this year.

As always, if your time horizon is beyond a few years, I’m confident that staying the course with your diversified investments is the best course of action.

So, how bad is it out there, and what can you do about it?

Let’s break down what’s going on and zoom out to see how normal this volatility is and the importance of staying invested for the long term.

Market Volatility

Over the past few weeks, the stock market has experienced quite a lot up choppiness while dropping from record highs.

This downturn has been primarily driven by escalating trade tensions initiated by President Trump's recent tariff announcements.

Specifically, investors are unsure about how this could impact inflation, corporate profits and the economy at large.

In addition, these tariffs have raised concerns about potential recessions, both domestically and globally.

Goldman Sachs, for instance, reduced its U.S. GDP growth forecast to 1.7% from 2.4%, citing tighter financial conditions and reduced consumer and business confidence as contributing factors.

Recessions normally occur in the US economy every eight years or so, and typically, we don’t know we’re in one until many months in.

3 Tips for Riding the Ups and Downs

1. Remember that this is normal

We as investors can expect both ups and downs as part of the rollercoaster ride that is stock-market investing.

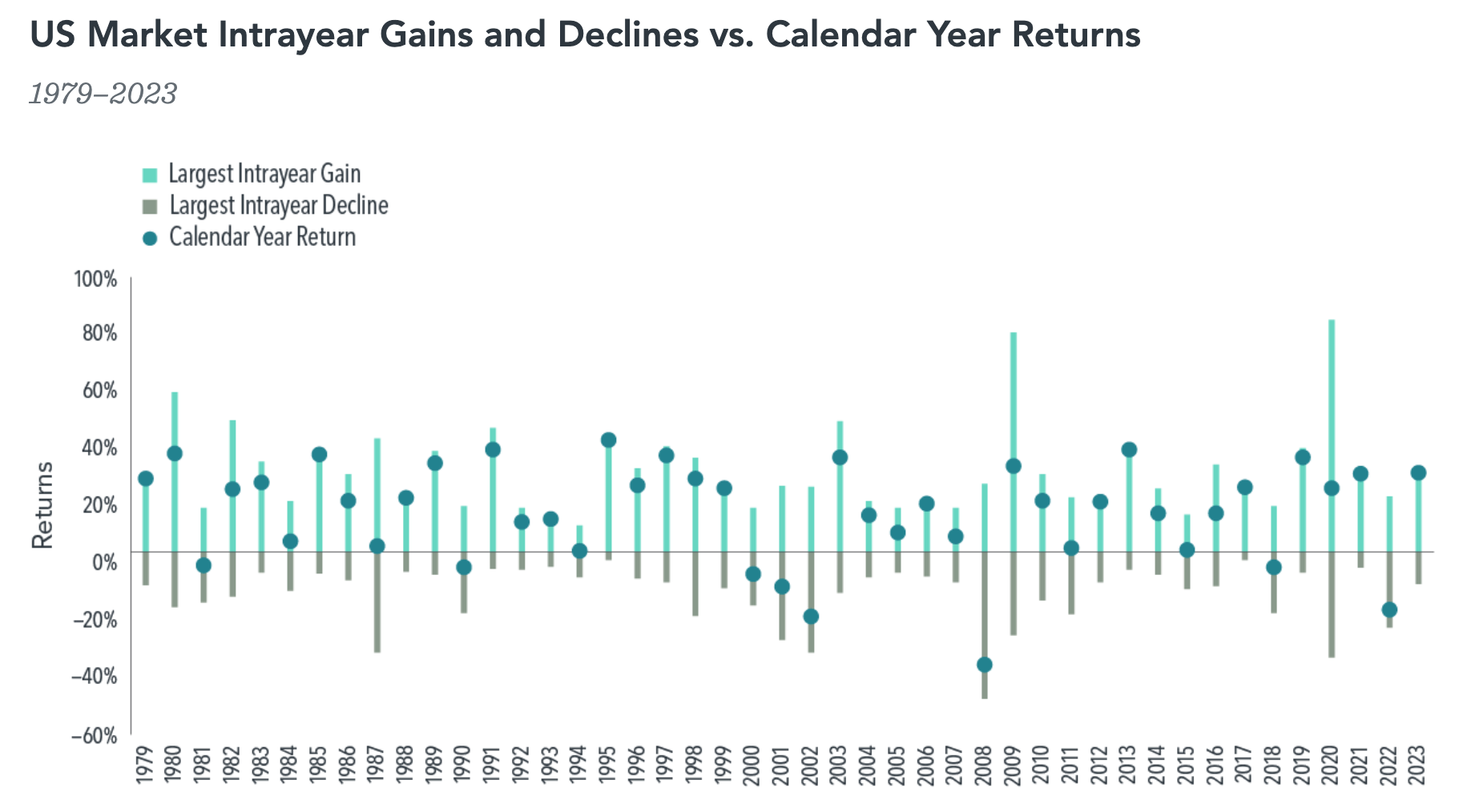

Decades of stock-market returns demonstrate how often declines can happen.

For instance, look at the largest declines for the US stock market in every year from 1979 to 2023. Those declines average to -14%.

This means that in each of the last nearly 50 years, the market has dropped an average of -14% within each of those years.

Despite this, 37 of the past 45 years have ended with positive returns for the US stock market!

As painful as it is to see negative numbers associated with our investments, please keep in mind, this is normal during a typical year and doesn’t mean the market will remain down.

2. Stay Invested

The markets have never not recovered. This is to say, the stock market has continually reached new highs throughout the years, and many agree this will continue to happen in the years to come…but, not without volatility along the way.

If we as investors want to take part in the good times, we need to also endure the bad times.

We don’t know when the market will recover, but when it does, it historically happens pretty quickly.

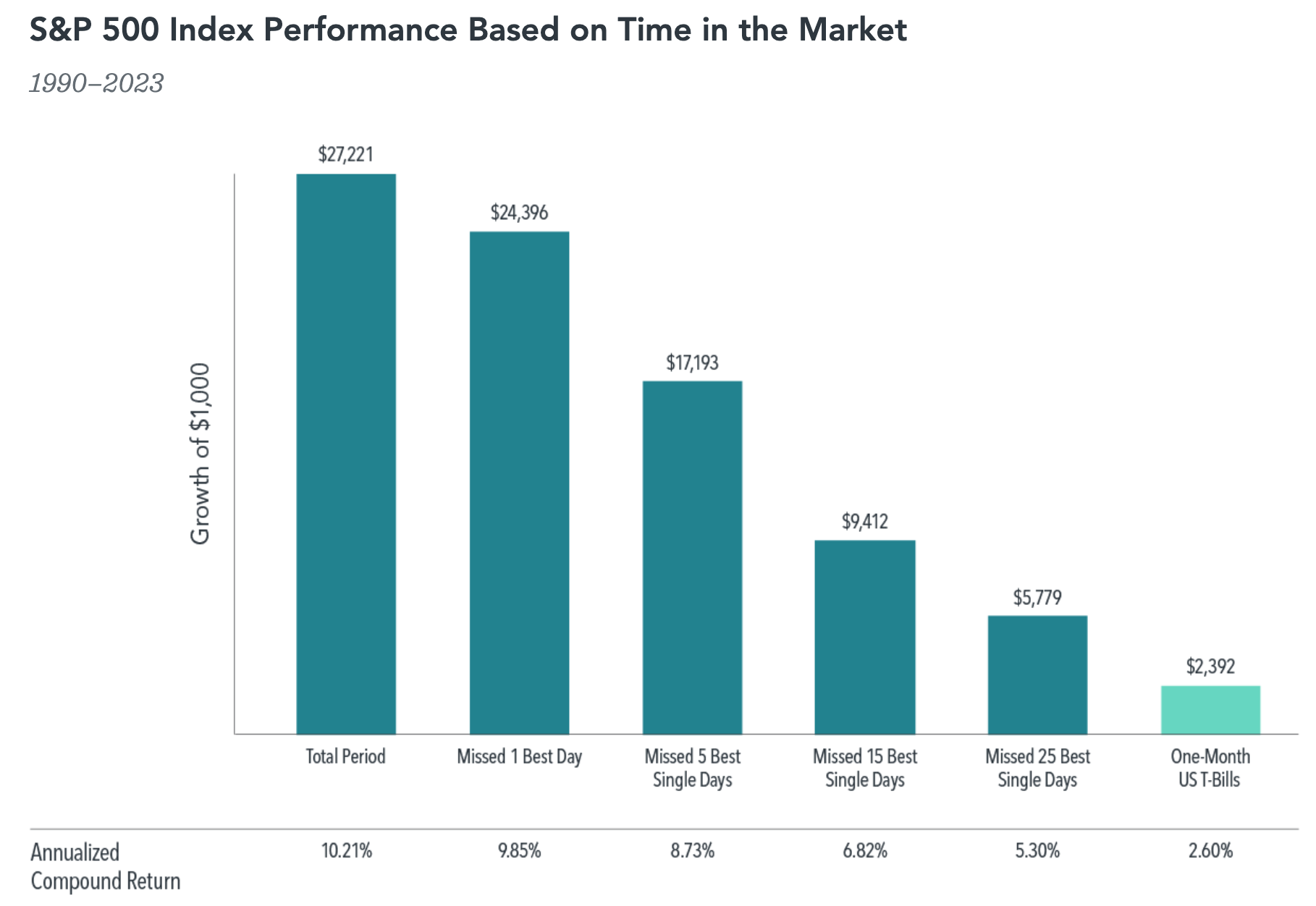

Let’s look at a hypothetical $1,000 invested in US stocks (the S&P 500) starting in 1990 through 2023. During that time, a $1,000 investment would have grown to $27,221 which translates into an annual return of 10.21%.

So, what would your average yearly return look like if you hypothetically sold out of your investment because the market fell, and you failed to get back in for the best recovery days during that time period?

Your 10.21% average annual return by staying invested would be diminished to:

9.85% by missing the 1 best recovery day

8.73% by missing the 5 best recovery days

6.82% by missing the 15 best recovery days

5.30% by missing 25 best recovery days

If you would have sold out of your portfolio during a downturn and missed out on less than one month of market recovery days, your returns would be halved during that time period!

This shows the importance of staying invested. After all, investing is about time IN the market not timing the market.

We don’t know when the good times or bad times will come, but I think it’s reasonable to assume that things will go well in the long run by simply staying the course.

3. Reassess your Risk Tolerance

If you’re particularly concerned about the recent market volatility, consider taking another look at your risk tolerance.

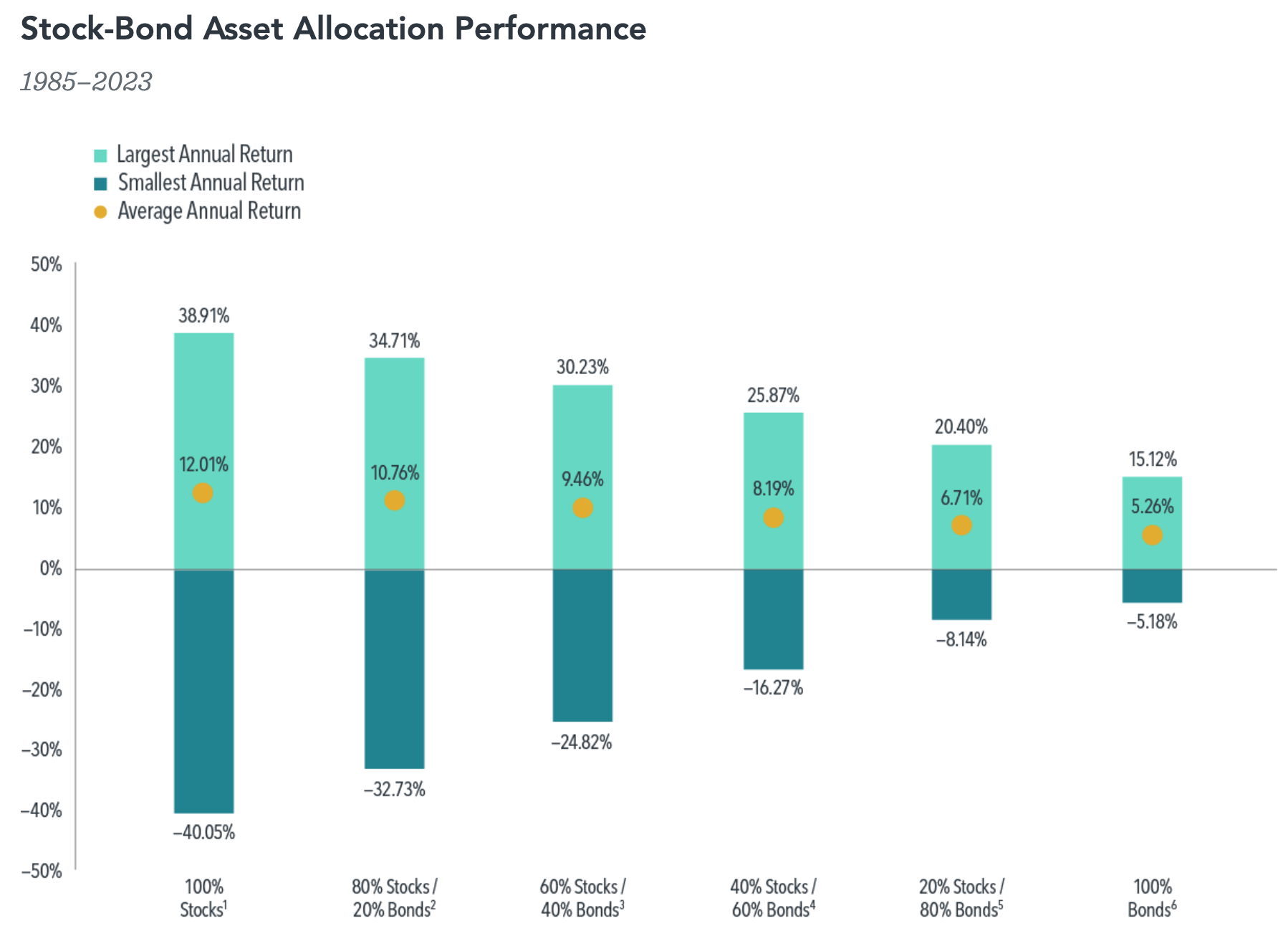

Your mix of stocks and bonds (i.e. your “asset allocation”) plays a huge role in the amount of risk you take as an investor and the severity of the ups and downs on your investing rollercoaster ride.

The more you invest in stocks (vs. bonds) the higher your return potential but the greater your potential downturns.

Your mix of stocks and bonds should align with your time horizon, risk tolerance, withdrawal needs, tax situation, etc.

I hope these nerdy charts help you stay in control and in your seat during this market volatility. You won’t regret staying the course on your way to your long-term financial goals!

The charts in this article were pulled from a great piece by Dimensional Fund Advisors on recent market volatility.

Do you have concerns about your investment portfolio? Reach out to me at Ben@coveplanning.com or schedule a free consultation call.

Sign up for Cove’s Build Your Wealth Newsletter to stay informed with the latest personal finance insights!

Ben Smith is a fee-only financial advisor and CERTIFIED FINANCIAL PLANNER™ (CFP®) Professional with offices in Milwaukee, WI, Evanston, IL and Wayzata, MN, serving clients virtually across the country. Cove Financial Planning provides comprehensive financial planning and investment management services to individuals and families, regardless of location, with a focus on Socially Responsible Investing (SRI).

Ben acts as a fiduciary for his clients. He does not sell financial products or take commissions. Simply put, he sits on your side of the table and always works in your best interest. Learn more how we can help you Do Well While Doing Good!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Ben Smith, and all rights are reserved. Read the full Disclaimer.